fromForbes

1 week agoMobile Isn't A Channel. It's The Primary Customer Experience

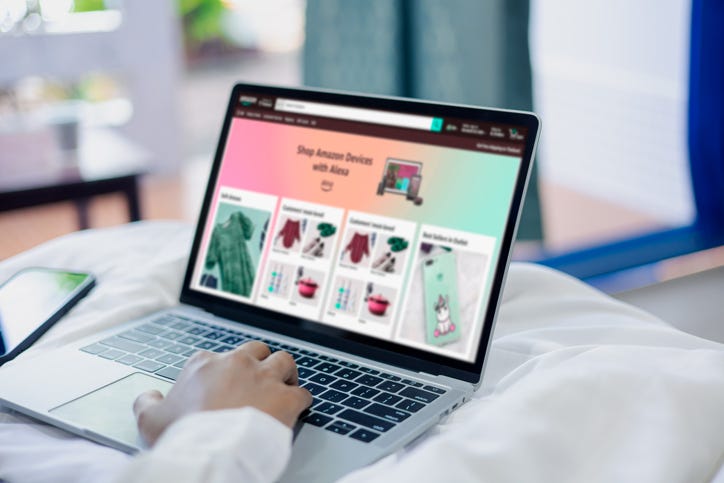

Do you remember when 2007 was dubbed "The year of mobile"? That was when Apple launched the iPhone and firmly established mobile as the secondary channel for online engagement, after the desktop. The company's approach was so revolutionary that, in today's world, the mobile experience has become the primary experience for brand and customer interaction. More people search for products and services on their phones than on any other platform.

Mobile UX